Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| RITE AID CORPORATION | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

September 27, 2018June 7, 2019

Dear Fellow Stockholders:

On behalf of the Board of Directors (the "Board") of Rite Aid Corporation ("Rite Aid" or the "Company"), weI want to take this opportunity to invite you to attend our 20182019 Annual Meeting of Stockholders. The meeting will be held at 8:30 a.m., local time, on Tuesday, October 30, 2018,Wednesday, July 17, 2019, at the New York Marriott Marquis, 1535 Broadway,office of Skadden, Arps, Slate Meagher & Flom LLP, Four Times Square, New York, NY 10036. At the meeting, stockholders will vote on the proposals set forth in the Notice of Annual Meeting and the accompanying proxy statement.

As a Board, our focus remainsAt Rite Aid, we remain focused on taking actions to best position Rite Aid for the long term in the face of the various industry, economic and company-specific challenges. Our top priorities include continuing to engage with our stockholders, executing on Rite Aid's strategic plan and creating long-term stockholder value. Rite Aid's network of conveniently located retail pharmacies, our EnvisionRxOptions Pharmacy Benefits Management (PBM) company and our trusted brand of health and wellness offerings provide a strong foundationCompany to create long-term value for stockholders. These include actions to use our stockholders.unique capabilities to help payors deliver a high level of care to patients, to re-imagine our front end to offer the selection of products and services that meet the needs of our target customers and to transform our processes and procedures to ensure strong cost discipline and achieve peak operational efficiency.

SinceOur actions to create long-term value for stockholders include our efforts to enhance the terminationquality of the Albertsons transaction, our Board has spearheaded a campaign toby bringing in fresh perspectives and valuable expertise and experience. A majority of Rite Aid directors have our independent directors engage with our stockholders. Independent directors and management together have reached out to 11 of our largest stockholders, owningjoined the Board in the aggregate approximately 38% of our shares, and independent directors have engaged directlypast eight months, with six of these stockholders to date, owning in the aggregate approximately 29% of our shares. In addition, management has communicated with many retail stockholders and received their feedback. We greatly value the insightful input about Rite Aid that our stockholders have provided in these and other exchanges.

Based on the feedback we received, and consistent with our commitment to align Rite Aid's interests with those of our stockholders, we are making several changes to strengthen and enhance the Board's governance oversight. First, the Board has decided to separate the positions of Chairman and Chief Executive Officer, and Bruce G. Bodaken will hold the position of Chairman effective at the 2018 Annual Meeting of Stockholders. The Board also has significantly accelerated its efforts to change the composition of the Board. As part of that refreshment process, three of our current eight independent directors will not be standing for re-election and we are nominating three new independent directors—Robert E.Bob Knowling, Jr., Louis P.Lou Miramontes and Arun Nayar. TheseNayar joining in October 2018 and Busy Burr and Kate Quinn joining in April 2019. In addition to their wealth of knowledge and experience, these changes willto our Board bring fresh perspectives to the opportunitiesa diversity of thought, as well as enhance our Board's gender, racial, and challenges before us. Our new director nominees, Bob, Lou and Arun, also bring public company experience, strategic planning skills and financial expertise to the Board. We are committed to continuing the Board refreshment process over the next year to ensureethnic diversity.

As we have the right mix of experience, expertise and fresh perspectives to guide Rite Aid going forward.

Onesaid previously, one of the Board's most important tasks is choosing the Company's Chief Executive Officer. After rigorousIn March, we announced a leadership transition and organizational restructuring to better align the structure and leadership of Rite Aid with its present scale. As part of this transition, we are currently in the process of searching for a new CEO. The Board recognizes the significance of this task and is conducting its process in a thoughtful evaluation and discussion,deliberate manner.

Both before and since the 2018 Annual Meeting, we have increased our efforts to engage with many of our larger stockholders and we value the input they have provided. In response to votes held at the 2018 Annual Meeting and engagement thereafter, we have enhanced our corporate governance structures by requiring the separation of the Chairman of the Board firmly believesand CEO positions and by providing stockholders with the right to call special meetings.

With respect to executive compensation, we took steps to further align pay and performance, including increasing the emphasis on performance-based (rather than time-based) long-term incentives for fiscal 2019 and refining our peer group for fiscal 2020 to, among other things, remove industry peers that John Standley is best situatedare no longer appropriate data points given their significantly larger scope of operations.

We continue our efforts to serve asensure that Rite Aid's Chief Executive Officer.business is operated in a sustainable and socially responsible manner. In reaching this conclusion,addition to moving forward on the Board considered his extensive industry experiencesustainability and in-depth understanding of all aspects ofopioid-related reports that stockholders voted for at the Company,2018 Annual Meeting, in April 2019, we announced enhanced efforts to promote responsible access to tobacco products by increasing the age to purchase tobacco products to 21 and removing e-cigarettes and vaping products chain-wide. We are also continuing to enforce our chain-wide "ID All" policy that requires identification to purchase age-restricted items, including its customers, operations and key business drivers.tobacco products. The Board believes this experiencecontinues to receive reports from management on sustainability and understanding will be vital to navigating the Company through its current challenges and building stockholder value for the long term, as well as providing stability to the Company's many constituents.

The Board also has been deeply involved in overseeing management's development of the strategic initiatives that the Company is undertaking to enhance stockholder value as a stand-alone company.opioid-related matters.

These initiatives As referenced above and described further in the accompanying proxy statement, we at Rite Aid have taken or are designed to capitalize on Rite Aid's valuable store and PBM businesses to grow revenues, improve efficiency and drive profitability. As partin the process of this effort,taking the actions that we are taking actions to drive prescription growth and front-end sales by working to expandsaid we would take—refreshing our access to preferred and limited networks, enhancing our pharmacy clinical capabilities to improve patient outcomes, leveraging our valuable Wellness brand, refining our merchandising efforts and expanding our omnichannel capabilities. Our actions also include expanding EnvisionRxOptions' Medicare Part D business, improving payor relations to stabilize reimbursement rate pressures, obtaining efficient generic drug pricing and continuing to control costs through a leaner, more efficient structure.

As the Board, continues to oversee management's implementation of these strategic initiatives, it believes that Mr. Standley's knowledge and experience are critical to their successful execution. Going forward, our new Chairman, Mr. Bodaken, and our other independent directors will continue to evaluate Mr. Standley's performance in executing these strategic initiatives, and will work with Mr. Standley to review, evaluate and develop all levels of senior management.

We view the governance changes described above as the first steps in reinvigorating our corporate governance practices and policies. Overpolicies, assessing management's performance, aligning pay for performance, overseeing the coming year, the Board will continuedevelopment of strategic initiatives, and being responsive to seek stockholder input and identify new candidates to further refresh the Board. We will also consider corporate governance enhancements, including addressing items specificallyissues raised by stockholders in the course of our recent and ongoing engagement efforts. The attached proxy statement contains additional information concerning topics raised by some of our stockholders in the course of that engagement and our review of additional corporate governance changes.stockholders. We look forward to continuing to engage with you.

Your vote is important to us. Please vote as soon as possible even if you plan to attend the Annual Meeting. We appreciate your continued ownership of Rite Aid shares and your support.

| Sincerely, | ||

| |||||

Bruce G. Bodaken |

| ||||||

Refer to the section titled "Cautionary Statement Regarding Forward-Looking Statements" for a discussion of risks and uncertainties that could cause actual results to differ materially from those projected.

RITE AID CORPORATION

P.O. BOX 3165

HARRISBURG, PENNSYLVANIA 17105

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on October 30, 2018July 17, 2019

To Our Stockholders:

What: | Our | |||||

When: |

| |||||

Where: |

| |||||

Why: | At this Annual Meeting, stockholders will be asked to: | |||||

1. | Elect | |||||

| 2. | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm; | |||||

| 3. | Approve, on an advisory basis, the compensation of our named executive officers as presented in the proxy statement; | |||||

| 4. | Consider and vote on | |||||

| 5. | Transact such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. | |||||

The close of business on September 10, 2018June 6, 2019 has been fixed as the record date for determining those Rite Aid stockholders entitled to vote at the Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will receive this notice of, and be eligible to vote at, the Annual Meeting and any adjournment or postponement of the Annual Meeting. The above items of business for the Annual Meeting are more fully described in the proxy statement accompanying this notice.

Your vote is important. Please read the proxy statement and the instructions on the enclosed proxy card and then, whether or not you plan to attend the Annual Meeting in person, and no matter how many shares you own, please submit your proxy promptly by telephone or via the Internet in accordance with the instructions on the enclosed proxy card, or by completing, dating and returning your proxy card in the envelope provided. This will not prevent you from voting in person at the Annual Meeting. It will, however, help to assure a quorum and to avoid added proxy solicitation costs.

You may revoke your proxy at any time before the vote is taken by delivering to the Secretary of Rite Aid a written revocation or a proxy with a later date (including a proxy by telephone or via the Internet) or by voting your shares in person at the Annual Meeting, in which case your prior proxy would be disregarded.

| By order of the Board of Directors | ||

| ||

James J. Comitale |

| | Page | |||

|---|---|---|---|---|

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | 1 | |||

STOCKHOLDER ENGAGEMENT, MANAGEMENT TRANSITION, AND BOARD REFRESHMENT | 7 | |||

PROPOSAL NO. 1 ELECTION OF DIRECTORS | ||||

BOARD OF DIRECTORS | ||||

DIRECTOR COMPENSATION TABLE FOR FISCAL YEAR | ||||

PROPOSAL NO. 2 RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||

PROPOSAL NO. 3 ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | ||||

STOCKHOLDER | ||||

PROPOSAL NO. 4 STOCKHOLDER PROPOSAL— | ||||

| ||||

| 31 | |||

EXECUTIVE | ||||

| ||||

COMPENSATION DISCUSSION AND ANALYSIS | ||||

COMPENSATION COMMITTEE REPORT | ||||

SUMMARY COMPENSATION TABLE | ||||

GRANTS OF PLAN-BASED AWARDS TABLE FOR FISCAL YEAR | ||||

EXECUTIVE EMPLOYMENT AND SEPARATION AGREEMENTS | ||||

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR | ||||

OPTION EXERCISES AND STOCK VESTED TABLE FOR FISCAL YEAR | ||||

NONQUALIFIED DEFERRED COMPENSATION FOR FISCAL YEAR | ||||

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL | ||||

PAY RATIO DISCLOSURE | ||||

AUDIT COMMITTEE REPORT | 67 | |||

EQUITY COMPENSATION PLAN INFORMATION | 69 | |||

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | ||||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | ||||

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | ||||

STOCKHOLDER PROPOSALS FOR THE | 73 | |||

INCORPORATION BY REFERENCE | ||||

OTHER MATTERS | ||||

IMPORTANT NOTICE REGARDING DELIVERY OF STOCKHOLDER DOCUMENTS | ||||

ANNUAL REPORT | ||||

APPENDIX A | A-1 | |||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | ||||

i

RITE AID CORPORATION

P.O. BOX 3165

HARRISBURG, PENNSYLVANIA 17105

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held on October 30, 2018July 17, 2019

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to be Held on October 30, 2018:July 17, 2019:

The proxy statement and annual report, as well as the Company's proxy card, are available at

www.proxyvote.com.

This proxy statement is being furnished to you by the Board of Directors (the "Board" or "Board of Directors") of Rite Aid Corporation (the "Company" or "Rite Aid") to solicit your proxy to vote your shares at our 20182019 Annual Meeting of Stockholders (the "Annual Meeting"). The Annual Meeting will be held on October 30, 2018July 17, 2019 at 8:30 a.m., local time, at the New York Marriott Marquis, 1535 Broadway,office of Skadden, Arps, Slate, Meagher & Flom LLP, Four Times Square, New York, NY 10036.

This proxy statement, the foregoing notice and the accompanying proxy card are first being mailed on or about September 27, 2018June 7, 2019 to all holders of our common stock, par value $1.00 per share, entitled to vote at the Annual Meeting. At Rite Aid and in this proxy statement, we refer to our employees as associates.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Who is entitled to vote at the Annual Meeting?

Holders of Rite Aid common stock as of the close of business on the record date, September 10, 2018,June 6, 2019, will receive notice of, and be eligible to vote at, the Annual Meeting and any adjournment or postponement of the Annual Meeting. At the close of business on the record date, Rite Aid had outstanding and entitled to vote 1,065,434,68253,828,701 shares of common stock. No other shares of Rite Aid capital stock are entitled to notice of and to vote at the Annual Meeting.

What matters will be voted on at the Annual Meeting?

There are sixfour proposals that are scheduled to be considered and voted on at the Annual Meeting:

Stockholders will also be asked to consider and vote at the Annual Meeting on any other matter that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. At this time, the Board of Directors is unaware of any matters, other than those set forth above, and the possible submission of the Weiss Proposal, as described in the section entitled "Other Matters," that may properly come before the Annual Meeting.

What are the Board's voting recommendations?

The Board recommends that you vote "FOR" the nominees of the Board in the election of directors, "FOR" the ratification of Deloitte & Touche LLP as the Company's independent registered public accounting firm, "FOR" the approval, on an advisory basis, of the compensation of our named executive officers as presented in this proxy statement, and "AGAINST" each of the stockholder proposals.proposal.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Broadridge Corporate Issuer Services, you are considered the "stockholder of record" with respect to those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee, those shares are held in "street name" and you are considered the "beneficial owner" of the shares. As the beneficial owner of those shares, you have the right to direct your broker, bank, or nominee how to vote your shares, and you will receive separate instructions from your broker, bank, or other holder of record describing how to vote your shares.

How can I vote my shares before the Annual Meeting?

If you hold your shares in your own name, you may submit a proxy by telephone, via the Internet, or by mail.

By casting your vote in any of the three ways listed above, you are authorizing the individuals listed on the proxy to vote your shares in accordance with your instructions. You may also attend the Annual Meeting and vote in person.

If your shares are held in the name of a bank, broker, or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted. The availability of telephonic or Internet voting will depend on the bank's, broker's, or broker'sother nominee's voting process. Please check with your bank, broker, or brokerother nominee and follow the voting procedures your bank, broker, or brokerother nominee provides to vote your shares. Also, please note that if the holder of record of

your shares is a bank, broker, or other nominee and you wish to vote in person at the Annual Meeting, you must request a legal proxy from your bank, broker, or other nominee that holds your shares and present that proxy and proof of identification at the Annual Meeting; otherwise, you will not be able to vote in person at the Annual Meeting.

If I am the beneficial owner of shares held in "street name" by my broker, will my broker automatically vote my shares for me?

New York Stock Exchange ("NYSE") rules applicable to brokers grant your broker discretionary authority to vote your shares without receiving your instructions on certain matters. Your broker has discretionary voting authority under NYSE rules to vote your shares on the ratification of Deloitte & Touche LLP as our independent registered public accounting firm. However, unless you provide voting instructions to your broker, your broker does not have discretionary authority to vote on the election of directors, the advisory vote on the compensation of our named executive officers, and the vote on the stockholder proposals.proposal.Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares.

How will my shares be voted if I give my proxy but do not specify how my shares should be voted?

If you provide specific voting instructions, your shares will be voted at the Annual Meeting in accordance with your instructions. If you hold shares in your name and sign and return a proxy card without giving specific voting instructions, your shares will be voted "FOR" the nominees of the Board in the election of directors, "FOR" the ratification of Deloitte & Touche LLP as the Company's independent registered public accounting firm, "FOR" the approval, on an advisory basis, of the compensation of our named executive officers, and "AGAINST" each of the stockholder proposals.proposal.

Could other matters be decided at the Annual Meeting?

At this time, we are unaware of any matters, other than those set forth above, and the possible submission of the Weiss Proposal, as described in the section entitled "Other Matters," that may properly come before the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named in the enclosed proxy, or their duly constituted substitutes acting at the Annual Meeting or any adjournment or postponement of the Annual Meeting, will be deemed authorized to vote or otherwise act on such matters in accordance with their judgment.

Who may attend the Annual Meeting?

All stockholders are invited to attend the Annual Meeting. Persons who are not stockholders may attend only if invited by the Board of Directors. If you are the beneficial owner of shares held in the name of your broker, bank, or other nominee, you must bring proof of ownership (e.g., a current broker's statement) in order to be admitted to the meeting. You can obtain directions to the Annual Meeting by contacting our Investor Relations Department at (717) 975-3710.

Can I vote in person at the Annual Meeting?

Yes. If you hold shares in your own name as a stockholder of record, you may come to the Annual Meeting and cast your vote at the meeting by properly completing and submitting a ballot.If you are the beneficial owner of shares held in the name of your broker, bank, or other nominee, you must first obtain a legal proxy from your broker, bank, or other nominee giving you the right to vote those shares

and submit that proxy along with a properly completed ballot at the meeting; otherwise, you will not be able to vote in person at the Annual Meeting.

How can I change my vote?

You may revoke your proxy at any time before it is exercised by:

Any written notice of revocation, or later dated proxy, should be delivered to:

Rite Aid Corporation

30 Hunter Lane

Camp Hill, Pennsylvania 17011

Attention: James J. Comitale, Secretary

Alternatively, you may hand deliver a written revocation notice, or a later dated proxy, to the Secretary at the Annual Meeting before we begin voting.

If your shares of Rite Aid common stock are held by a bank, broker, or other nominee, you must follow the instructions provided by the bank, broker, or other nominee if you wish to change your vote.

What is an "abstention" and how would it affect the vote?

An "abstention" occurs when a stockholder sends in a proxy with explicit instructions to decline to vote regarding a particular matter. Abstentions are counted as present for purposes of determining a quorum. An abstention with respect to the election of directors is neither a vote cast "for" a nominee nor a vote cast "against" the nominee and, therefore, will have no effect on the outcome of the vote. Abstentions with respect to the ratification of Deloitte & Touche LLP as our independent registered public accounting firm, the advisory vote on compensation of our named executive officers, and the vote on the stockholder proposalsproposal will have the same effect as voting "against" the proposal.

What is a broker "non-vote" and how would it affect the vote?

A broker non-vote occurs when a broker or other nominee who holds shares for the beneficial owner is unable to vote those shares for the beneficial owner because the broker or other nominee does not have discretionary voting power for the proposal and has not received voting instructions from the beneficial owner of the shares. Brokers will have discretionary voting power to vote shares for which no voting instructions have been provided by the beneficial owner only with respect to the ratification of Deloitte & Touche LLP as our independent registered public accounting firm. Brokers will not have such discretionary voting power to vote shares with respect to the election of directors, the advisory vote on the compensation of our named executive officers, and the vote on the stockholder proposals.proposal. Shares that are the subject of a broker non-vote are included for quorum purposes, but a broker non-vote with respect to a proposal will not be counted as a vote cast and will not be counted as a vote represented at the meeting and entitled to vote and, consequently, will have no effect on the

outcome of the vote. Accordingly, it is particularly important that beneficial owners of Rite Aid shares instruct their brokers how to vote their shares.

What are the quorum and voting requirements for the proposals?

In deciding the proposals that are scheduled for a vote at the Annual Meeting, each holder of common stock as of the record date is entitled to one vote per share of common stock. In order to take action on the proposals, a quorum, consisting of the holders of 532,717,34226,914,351 shares (a majority of the aggregate number of shares of Rite Aid common stock) issued and outstanding and entitled to vote as of the record date for the Annual Meeting, must be present in person or by proxy. This is referred to as a "quorum." Proxies marked "Abstain" and broker non-votes will be treated as shares that are present for purposes of determining the presence of a quorum.

Proposal No. 1—Election of Directors

The affirmative vote of a majority of the total number of votes cast is required for the election of each director nominee named in Proposal No. 1. This means that the votes cast "for" that nominee must exceed the votes cast "against" that nominee. Any shares not voted (whether by abstention, broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the outcome of the vote. For more information on the operation of our majority voting standard, see the section entitled "Board of Directors—Corporate Governance—Majority Voting Standard and Policy."

Proposal No. 2—Ratification of Independent Registered Public Accounting Firm

The affirmative vote of a majority of the shares represented at the meeting and entitled to vote is required for the ratification of Deloitte & Touche LLP as our independent registered public accounting firm in Proposal No. 2. Any shares represented and entitled to vote at the meeting and not voted (whether by abstention or otherwise) will have the same effect as a vote "against" the proposal.

Proposal No. 3—Advisory Vote on Compensation of Named Executive Officers

The affirmative vote of a majority of the shares represented at the meeting and entitled to vote is required for the approval of the advisory vote on the compensation of our named executive officers in Proposal No. 3. Any shares represented and entitled to vote at the meeting and not voted (whether by abstention or otherwise) will have the same effect as a vote "against" the proposal. Any broker non-votes with respect to the advisory vote on the compensation of our named executive officers will not be counted as shares represented at the meeting and entitled to vote and, consequently, will have no effect on the outcome of the vote.

Proposal No. 4,4—Stockholder Proposal No. 5 and Proposal No. 6—Stockholder Proposals

The affirmative vote of a majority of the shares represented at the meeting and entitled to vote is required for the approval of each of the stockholder proposalsproposal in Proposal No. 4, Proposal No. 5 and Proposal No. 6.4. Any shares represented and entitled to vote at the meeting and not voted (whether by abstention or otherwise) will have the same effect as a vote "against" the stockholder proposals.proposal. Any broker non-votes with respect to the stockholder proposalsproposal will not be counted as shares represented at the meeting and entitled to vote and, consequently, will have no effect on the outcome of the vote.

What happens if a quorum is not present at the Annual Meeting?

If the shares present in person or represented by proxy at the Annual Meeting are not sufficient to constitute a quorum, the stockholders by a vote of the holders of a majority of votes present in person or represented by proxy (which may be voted by the proxyholders) may, without further notice to any

stockholder (unless a new record date is set), adjourn the meeting to a different time and place to permit further solicitations of proxies sufficient to constitute a quorum.

Who will count the votes?

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspectors of election.

Who will conduct the proxy solicitation and how much will it cost?

We are soliciting proxies from stockholders on behalf of our Board and will pay for all costs incurred by it in connection with the solicitation. In addition to solicitation by mail, the directors, officers and associates of Rite Aid and its subsidiaries may solicit proxies from stockholders of Rite Aid in person or by telephone, facsimile, or email without additional compensation other than reimbursement for their actual expenses.

We have retained Morrow Sodali, LLC, a proxy solicitation firm, to assist us in the solicitation of proxies for the Annual Meeting. Rite Aid will pay Morrow Sodali a fee of approximately $20,000, plus reasonable out-of-pocket expenses.

Arrangements also will be made with brokerage firms and other custodians, nominees, and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held of record by such persons, and we will reimburse such custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses in connection with the forwarding of solicitation materials to the beneficial owners of our stock.

If you have any questions about voting your shares or attending the Annual Meeting, please call our Investor Relations Department at (717) 975-3710.

STOCKHOLDER ENGAGEMENT, MANAGEMENT TRANSITION, AND BOARD REFRESHMENT

FollowingSince the termination of the Albertsons transaction in August 2018 and following the 2018 Annual Meeting, we have engaged in enhanced stockholder outreach efforts. Our independent directors and management together have reached out to 11 of our largest stockholders, owning in the aggregate approximately 38% of Rite Aid shares, and independent directors have engaged directly with six of these stockholders to date, owning in the aggregate approximately 29% of Rite Aid shares. These efforts provided an opportunity for independent directors to hear from stockholders directly regarding their perspectives and concerns. In addition, management has communicated with many retail stockholders and received their feedback. We greatly value the insightful input about the Company that our stockholders have provided in these and other exchanges.exchanges over the past ten months. The feedback from these efforts washas been summarized, shared, and considered by the Nominating and Governance Committee and the full Board.

Investors raised a number of concerns and the Board has taken significant steps to address these items, with more work to be done.items. Specifically, the principal issues raised by our stockholders related to: (1) Board refreshment, (2) an evaluation of management, (3) corporate governance matters, and (4) the Company's sustainability efforts.

New Board Leadership and Composition

In the course of our stockholder engagement meetings over the past ten months, stockholders expressed concerns regarding the lack of Board refreshment in recent years, as well as concerns regarding our Board governance. The Board has reviewed its structure in light of the Company's current operating and governance environment and, determined that, effective at the 2018 Annual Meeting, Mr. Standley will bewas succeeded as Chairman of the Board by Bruce G. Bodaken. TheSubsequently, in December 2018, the Board believesamended the Company's By-Laws to provide that Mr. Bodaken will provide excellent leadershipthe Chairman of the Board in his role as Chairman. Mr. Bodaken brings toshall be a director who is independent under the position in-depth knowledge ofNYSE listing standards and the health insurance and managed care industries and more than 20 years of executive leadership skills. Moreover, theCompany's Corporate Governance Guidelines.

The Board has significantly accelerated its efforts to change the composition of the Board. As part of this process, at the 2018 Annual Meeting, three of the current eight independent directors aredid not standingstand for re-electionreelection and the Board has nominated three new independent directors. Robert E. Knowling, Jr., Louis P. Miramontes and Arun NayarAs a continuation of this process, two new directors were appointed by the Board following the resignation of two of our directors in April 2019. The five directors who have joined the Board over the past eight months will continue to bring fresh perspectives to the Board, as well as public company experience, strategic planning skills and financial expertise.Board. In addition, Mr. Standley has not been nominated for reelection at the Annual Meeting.

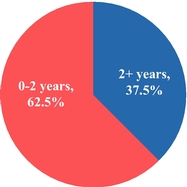

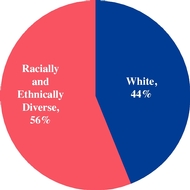

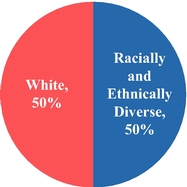

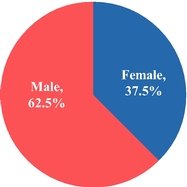

The Board sought to balance the need for new perspectives while retaining the benefit of current members' deep understanding of the Company's business, strategy and challenges. The Board also considered current directors' time availability in light of their other business commitments. As a result of these changes in the Board's composition, the average tenure of our independent directors will decreasehas decreased from approximately eight years prior to the 2018 Annual Meeting to approximately sixfour years, with a relatively even distribution among new directors directors of medium tenure and directors of longer tenure. Through the Board refreshment process, the Board will increasehas increased the racial and ethnic diversity on the Board, with a majorityhalf of the Board being racially and ethnically diverse.diverse following the Annual Meeting. The Board recognizes that its gender diversity will decrease in connection with this initial stage of refreshment and is committed to considering women candidates and makingalso made gender diversity a priority as part of its ongoingmost recent phase of its refreshment, resulting in the coming year.

In the coursemore than one-third of this refreshment process, theour Board considered the fact that Joseph B. Anderson, Jr. exceeds the Board's retirement age and decided to waive this requirement for Mr. Anderson's nomination this year. Specifically, the Board concluded that, in light of the number of directors not standing for re-election and the number of new directors nominated for election atbeing women following the Annual Meeting, the Board would benefit from Mr. Anderson's continued service on the Board, as he would bring important experience and knowledge about the Company that would be beneficial as the new Board members continue to gain familiarity with Rite Aid's business. As the Board refreshment processMeeting.

Table of ContentsManagement Transition

continues over the next year, the Board does not anticipate waiving this requirement for Mr. Anderson beyond this Annual Meeting.

Moving forward, the Board refreshment process will continue over the next year to ensure we have the right mix of experience, expertise and fresh perspectives to guide Rite Aid going forward. The Board recognizes that stockholders expect the initial steps we are taking this year in the refreshment process to be the beginning and not the end.

Evaluation of Management

In the course of our recent engagement efforts, stockholders sought confirmation that the Board has considered and evaluated management. One of the Board's most important tasks is choosing the Company's Chief Executive Officer. AfterFollowing the 2018 Annual Meeting, the Board continued to engage in rigorous and thoughtful evaluation and discussion regarding the Chief Executive Officer and other management positions. In March 2019, the Company announced a leadership transition and organizational restructuring to better align its structure with the Company's operations and to reduce costs. As part of the leadership transition, the Company announced that the Board has reaffirmed its strongly held belief that John Standley is best situated to serve as Rite Aid'swould be commencing a search process for a new Chief Executive Officer. In making this determination, the Board considered his extensive industry experience and in-depth understanding of all aspects of the Company, including its customers, operations and key business drivers. The Board believes this experience and understanding will be vital to navigating the Company through its current challenges and building stockholder value for the long term, as well as providing stability to the Company's many constituents.

Our mission is to improve the health and wellness of our communities through engaging experiences that provide our customers with the best products, services and advice to meet their unique needs. To achieve this mission, we are focused on three strategic priorities: serving as the trusted advisor of our pharmacy customers, providing our customers with a convenient and personalized shopping experience and building a winning value proposition for payors and providers.

In order to achieve these priorities, the Board has been deeply involved in overseeing management's development and implementation of a number of strategic initiatives which are designed to capitalize on Rite Aid's valuable store and pharmacy benefit manager ("PBM") businesses to grow revenues, improve efficiency and drive profitability. This includes taking actions to drive prescription growth and front-end sales by working to expand our access to preferred and limited networks, enhancing our pharmacy clinical capabilities to improve patient outcomes, leveraging our valuable Wellness brand, refining our merchandising efforts and expanding our omnichannel capabilities. In addition, we are focused on expanding PBM EnvisionRxOptions' Medicare Part D business, improving payor relations to stabilize reimbursement rate pressures, obtaining efficient generic drug pricing and continuing to control costs through a leaner, more efficient structure.

The Board believes that Mr. Standley's knowledge and experience are critical to moving forward quickly on these strategic initiatives, many of which are underway. Going forward, our new Chairman, Bruce G. Bodaken, and our other directors, all of whom are independent directors other than Mr. Standley will continue to serve as Chief Executive Officer of the Board's ongoing role in evaluating Mr. Standley's performance in executing these strategic initiatives, and will work with Mr. StandleyCompany until the appointment of his successor but has not been nominated for reelection to review, evaluate and develop all levels of senior management.

Additional Corporate Governance Changes

Over the coming year, the Board plans to consider certain corporate governance practices, including items of discussion raised inat the course of our recent stockholder engagement efforts. The Board also will consider the Investor Stewardship Group Principles to determine whether other changes are appropriate as part of the effort to address stockholder concerns relating to corporate governance matters.

The Board also will consider enhancements to its current oversight of the Company's environmental practices and sustainability efforts. The Company views sustainability business principles

as partAnnual Meeting. The Company also announced additional management changes, which were effective in March 2019, and consolidated additional senior leadership roles that resulted in the elimination of our overall business strategy, andcertain positions.

Additional Corporate Governance Changes

Since the 2018 Annual Meeting, the Board receives periodic updates fromhas considered and taken action with respect to certain corporate governance practices. In discussions with stockholders, some stockholders expressed a desire for Rite Aid stockholders to have the right to call a special meeting. In addition, our Nominating and Governance Committee has been monitoring trends and developments relating to special meeting rights. As a result of these discussions and trends, in April 2019, the Board amended the Company's management onBy-Laws to permit special meetings of the stockholders of the Company to be called by stockholders holding at least 20% of the Company's common stock.

At the 2018 Annual Meeting, stockholders approved a proposal requesting that Rite Aid prepare a sustainability initiatives.report describing the Company's environmental, social and governance ("ESG") risks and opportunities. The Company anticipates that a report describing the Company's ESG risks and opportunities will be released prior to the Annual Meeting. Additional details regarding the Company's consideration of sustainability matters and the related business initiatives the Company has undertaken in recent years are described in the section entitled "Board of Directors—Sustainability."

At the 2018 Annual Meeting, stockholders approved a proposal requesting that Rite Aid prepare a report describing the corporate governance changes the Company has implemented since 2012 to more effectively monitor and manage financial and reputational risks related to the opioid crisis. The BoardCompany anticipates continuing its stockholder engagement effortsthat a report describing the Company's approach to oversight of opioid matters will be released by October 1, 2019. Additional details regarding the Company's oversight of opioid matters and the related business initiatives the Company has undertaken in recent years are described in the coming year in order to ensure that it is receiving stockholder feedback as the Company continues to move forward. The processsection entitled "Board of enhancing our corporate governance and refreshing our Board has only just begun, and we plan to continue these efforts moving forward.Directors—Opioid Matter Oversight."

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

Our By-Laws provide that the Board of Directors may be composed of up to 15 members, with the number to be fixed from time to time by the Board. The Board has fixed the number of directors at nine,eight effective as of the Annual Meeting, and there are nineeight nominees for director at our Annual Meeting.

Director Nominees

The Board of Directors, based on the recommendation of the Nominating and Governance Committee, has nominated Joseph B. Anderson, Jr., Bruce G. Bodaken, Elizabeth 'Busy' Burr, Robert E. Knowling, Jr., Kevin E. Lofton, Louis P. Miramontes, Arun Nayar, Michael N. Regan, John T. StandleyKatherine Quinn, and Marcy Syms to be elected directors at the Annual Meeting. Other than Mr. Knowling, Mr. Miramontes and Mr. Nayar, eachEach of the nominees for director to be elected at the Annual Meeting currently serves as a director of the Company. In selecting Mr. AndersonStandley will continue to serve as a nominee,Chief Executive Officer of the Board considered Mr. Anderson's age voted to waiveCompany until the requirement that a nomineeappointment of his successor but has not yet reached the age of 72. Specifically, the Board concluded that, in light of the number of directors not standing for re-election and the number of new directorsbeen nominated for electionreelection at the Annual Meeting, the Board would benefit from Mr. Anderson's continued service on the Board, as he would bring important experience and knowledge about the Company's strategy and challenges that would be beneficial as the new Board members continue to gain familiarity with Rite Aid's business. As the Board refreshment process continues over the next year, the Board does not anticipate waiving this requirement for Mr. Anderson beyond this Annual Meeting.

Each director elected at the Annual Meeting will hold office until the 20192020 Annual Meeting of Stockholders. Each director elected at the Annual Meeting will serve until his or her successor is duly elected and qualified.

If any nominee at the time of election is unable or unwilling to serve or is otherwise unavailable for election, and as a consequence thereof other nominees are designated, then the persons named in the proxy or their substitutes will have the discretion and authority to vote or to refrain from voting for other nominees in accordance with their judgment.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE.

The following table sets forth certain information as of September 10, 2018May 31, 2019 with respect to our director nominees. If elected, the term of each of the following persons will expire at the 20192020 Annual Meeting of Stockholders.

Name | Age | Position with Rite Aid | Year First Became Director | Age | Position with Rite Aid | Year First Became Director | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| John T. Standley | 55 | Chairman and Chief Executive Officer | 2009 | |||||||||||||||

| Joseph B. Anderson, Jr. | 75 | Director | 2005 | |||||||||||||||

| Bruce G. Bodaken | 66 | Director | 2013 | 67 | Chairman | 2013 | ||||||||||||

| Elizabeth 'Busy' Burr | 57 | Director | 2019 | |||||||||||||||

| Robert E. Knowling, Jr. | 63 | Nominee | — | 63 | Director | 2018 | ||||||||||||

| Kevin E. Lofton | 63 | Director | 2013 | 64 | Director | 2013 | ||||||||||||

| Louis P. Miramontes | 64 | Nominee | — | 64 | Director | 2018 | ||||||||||||

| Arun Nayar | 67 | Nominee | — | 68 | Director | 2018 | ||||||||||||

| Michael N. Regan | 70 | Director | 2007 | |||||||||||||||

| Katherine Quinn | 54 | Director | 2019 | |||||||||||||||

| Marcy Syms | 67 | Director | 2005 | 68 | Director | 2005 | ||||||||||||

Board Composition

The Board is committed to ensuring that it is composed of a highly capable and diverse group of directors who are well-equipped to oversee the success of the business and effectively represent the interests of stockholders. In addition, the Board believes that having directors with a mix ofboth longer and shorter tenures on the Board helps transition the knowledge of the more experienced directors while providing a broad, fresh set of perspectives and a Board with a diversity of experiences and viewpoints. As discussed in the section entitled "Stockholder Engagement, Management Transition, and Board Refreshment" above, the Board has significantly accelerated its efforts to change the composition of the Board. As part of this process, three current directors are not standing for re-election andBoard over the Board has nominated three new independent directors.past eight months. All of the nominees of the Board are independent directors, except for Mr. Standley.directors.

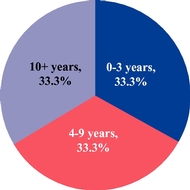

As a result of these changes in the Board's composition, the average tenure of our independent directors will decreasehas decreased from approximately eight years prior to the 2018 Annual Meeting to approximately sixfour years, with a relatively even distribution among new directors directors of medium tenure and directors of longer tenure. In addition, a majorityhalf of the Board will be racially and ethnically diverse.diverse following the Annual Meeting. The Board recognizes that its gender diversity will decrease in connection with this initial stage of refreshment and is committed to considering women candidates and makingalso made gender diversity a priority as part of its ongoingmost recent phase of its refreshment, resulting in more than one-third of our Board being women following the coming year.Annual Meeting.

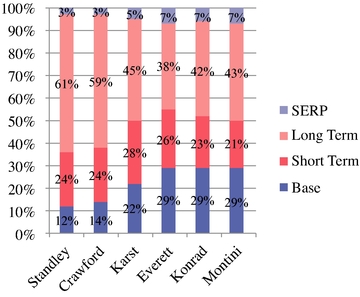

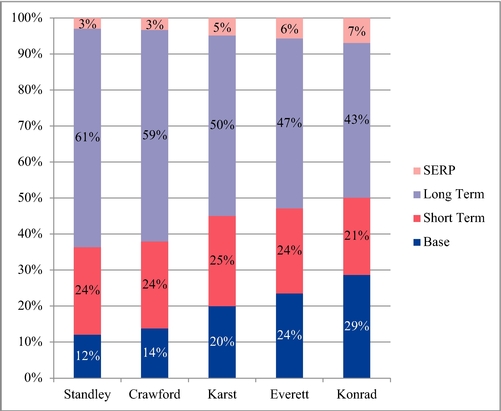

| Director Tenure* | Board Racial and Ethnic Diversity* | |

|   | |

Board Gender Diversity* | ||

| ||

In assessing Board composition and selecting and recruiting director candidates, the Board seeks to maintain an engaged, independent Board with broad experience and judgment that is committed to representing the long-term interests of our stockholders. The Nominating and Governance Committee considers a wide range of factors, including the size of the Board, the experience and expertise of existing Board members, other positions the director candidate has held or holds (including other

board memberships), and the candidate's independence. In addition, the Nominating and Governance Committee takes into account a candidate's ability to contribute to the diversity of background and experience represented on the Board, and it reviews its effectiveness in balancing these considerations when assessing the composition of the Board. The Board and Nominating and Governance Committee will continue to evaluate the composition of the Board as a whole as part of its ongoing refreshment in the coming year.

Prior toSince the 2018 Annual Meeting, the Nominating and Governance Committee sought to recruitcontinue the process of recruiting additional Board members whose qualifications align with the Company's refreshment process and long-term strategy. After considering a number of candidates and comprehensively reviewing these candidates' abilities and qualifications in sourcing candidates to fill the vacancies on the Board due to Joseph B. Anderson's and Michael N. Regan's resignations, the Nominating and Governance Committee recommended Mr. Knowling, Mr. MiramontesBusy Burr and Mr. NayarKatherine Quinn for electionappointment to the Board.

Table of Contents The Board appointed both candidates as directors in April 2019.

The chart below summarizes the qualifications, attributes, and skills for each of our director nominees. The fact that we do not list a particular experience or qualification for a director nominee does not mean that nominee does not possess that particular experience or qualification.

Skills and Experience | Knowling | Lofton | Miramontes | Syms | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Current/Former CEO | X | X | X | X | ||||||||||||||||||||||||||||||

Management/Business Operations | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||

Retail Industry | ||||||||||||||||||||||||||||||||||

| X | X | X | |||||||||||||||||||||||||||||||

| X | X | X | X | ||||||||||||||||||||||||||||||

Finance/Accounting | X | X | X | |||||||||||||||||||||||||||||||

Board/Corporate Governance | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||

Director Biographies

Following are the biographies for our director nominees, including information concerning the particular experience, qualifications, attributes, or skills that led the Nominating and Governance Committee and the Board to conclude that such person should serve on the Board:

John T. Standley. Mr. Standley, Chairman and Chief Executive Officer, has been Chairman of the Board since June 21, 2012, Chief Executive Officer since June 2010 and was President from September 2008 until June 2013. Mr. Standley served as the Chief Operating Officer from September 2008 until June 2010. He also served as a consultant to Rite Aid from July 2008 to September 2008. From August 2005 through December 2007, Mr. Standley served as Chief Executive Officer and was a member of the board of directors of Pathmark Stores, Inc. From June 2002 to August 2005, he served as Senior Executive Vice President and Chief Administrative Officer of Rite Aid and, in addition, in January 2004 was appointed Chief Financial Officer of Rite Aid. He had served as Senior Executive Vice President and Chief Financial Officer of Rite Aid from September 2000 to June 2002 and had served as Executive Vice President and Chief Financial Officer of Rite Aid from December 1999 until September 2000. Mr. Standley served on the SUPERVALU INC. board of directors from May 2013 to July 2015 and on the board of directors of CarMax, Inc. from August 2017 to January 2018. Mr. Standley currently serves on the National Association of Chain Drug Stores' board of directors and is a member of the Board's Executive Committee.

As the Company's Chief Executive Officer, with more than 30 years of retail, financial and executive experience, Mr. Standley brings to the Board an in-depth understanding of all aspects of the Company, including its customers, operations and key business drivers. In addition, his experience serving as a chief financial officer of a number of companies, including the Company, provides the Board with additional insights into financial and accounting matters relevant to the Company's operations.

Joseph B. Anderson, Jr. Mr. Anderson has been the Chairman of the Board and Chief Executive Officer of TAG Holdings, LLC, a manufacturing, service and technology business, since January 2002. Mr. Anderson was Chairman of the Board and Chief Executive Officer of Chivas Industries, LLC from 1994 to 2002. Mr. Anderson also served as a director of Meritor, Inc. until January 2017. Mr. Anderson previously served as a director of NV Energy Inc. until December 2013, Valassis Communications, Inc. until February 2014 and Quaker Chemical Corporation until May 2016.

Mr. Anderson has a broad base of experience, including 20 years of chief executive officer experience at manufacturing, service and technology companies. From this experience, Mr. Anderson brings an array of skills, including in the areas of strategic, business and financial planning and corporate development. In addition, his service on the boards of directors of a number of publicly-

traded companies provides the Board with insights into how boards at other companies have addressed issues similar to those faced by the Company.

Bruce G. Bodaken. Mr. Bodaken served as Chairman and Chief Executive Officer of Blue Shield of California from 2000 through 2012. Previously, Mr. Bodaken served as President and Chief Operating Officer of Blue Shield of California from 1995 to 2000, and as Executive Vice President and Chief Operating Officer from 1994 to 1995. Prior to joining Blue Shield of California, Mr. Bodaken served as Senior Vice President and Associate Chief Operating Officer of F.H.P., Inc., a managed care provider, from 1990 to 1994 and held various positions at F.H.P. from 1980 to 1990. Currently, Mr. Bodaken sits on the board of WageWorks, Inc., and is a member of its audit committee. He is also a director and member of the Compensation Committee of iRhythm Technologies, Inc. and a Lecturer in the Department of Public Health at UC Berkeley.

Mr. Bodaken brings to the Board in-depth knowledge of the health insurance and managed care industries and more than 20 years of executive leadership skills.

Busy Burr. Ms. Burr most recently served as the chief innovation officer and vice president of healthcare trend and innovation at Humana where she was responsible for driving the design, build and adoption of new product platforms in digital health, provider experience, and telemedicine to improve health outcomes, create superior member experiences, and improve health care costs. She also founded Humana's strategic investing practice, Humana Health Ventures. Prior to joining Humana in 2015, Ms. Burr was managing director of Citi Ventures and led large-scale business transformation efforts as the global head of Citi's Business Incubation Function-DesignWorks. Earlier in her career, Ms. Burr spent seven years in investment banking at Morgan Stanley and Credit Suisse First Boston and previously served as vice president of global brand management at Gap, Inc. Ms. Burr holds an MBA

from Stanford University and a bachelor's degree in Economics from Smith College. Ms. Burr serves on the Boards of Mr. Cooper Group and Satellite Healthcare and is a member of the Smith College Business Network Advisory Board.

Ms. Burr brings to the Board extensive experience in the health industry, innovation, business strategy and brand management. Her experience and insights in these areas are directly relevant to the Company's business.

Robert E. Knowling, Jr. Mr. Knowling is currently Chairman of Eagles Landing Partners, which specializes in helping senior management formulate strategy, lead organizational transformations, and re-engineer businesses. Mr. Knowling also serves as an advisor-coach to chief executive officers. Mr. Knowling previously served as Chief Executive Officer of Telwares, a JP Morgan Chase/One Equity Partners Private Equity-owned company from 2005 to 2009. From 2001 to 2005, Mr. Knowling was Chief Executive Officer of the New York City Leadership Academy, an independent nonprofit corporation created by Chancellor Joel I. Klein and Mayor Michael R. Bloomberg that is chartered with developing the next generation of principals in the New York City public school system. From 2001 to 2003, Mr. Knowling was Chairman and Chief Executive Officer of SimDesk Technologies, Inc. Prior to this, Mr. Knowling was Chairman, President and Chief Executive Officer of Covad Communications, a Warburg Pincus Private Equity backedEquity-backed start-up company. Mr. Knowling currently serves on the board of directors of Convergys Corporation, K12 Inc. and Roper Technologies Inc. Mr. Knowling previously served as a director of Convergys Corporation until 2018, Ariba, Inc. until 2012, Heidrick & Struggles International, Inc. until 2015, Hewlett-Packard Company until 2005, and The Immune Response Corporation until 2005.

Mr. Knowling brings to the Board extensive experience in executive management and leadership roles, including experience leading companies through periods of high growth and organizational turnaround. In addition, his service on other boards of directors of a number of publicly-traded companies enables Mr. Knowling to share insights with the Board regarding corporate governance best practices.

Kevin E. Lofton. Mr. Lofton has served as thewas named Chief Executive Officer of Denver-basedChicago-based CommonSpirit Health ("CSH"), effective February 1, 2019. CSH is the result of a merger between Catholic Health Initiatives ("CHI"), a healthcare system operating and Dignity Health. With $29 billion in revenues, CSH is one of the full continuum of services from hospitals to homelargest health agencies nationwide since 2003delivery systems in the United States. Mr. Lofton joined CHI in 1998 and served as President and CEO of CHI from 2003 throughuntil January 2014.2019. Mr. Lofton previously served as Chief Executive Officer of the UAB Hospital in Birmingham and Howard University Hospital in Washington, D.C. Mr. Lofton is also a director and member of the audit and compensation committees of Gilead Sciences, Inc.

Mr. Lofton brings to the Board an in-depth knowledge and understanding of the healthcare industry and valuable executive leadership skills from senior management and leadership roles in healthcare systems and hospitals.

Louis P. Miramontes. Mr. Miramontes worked at KPMG LLP from 1976 to 2014, where he served in many leadership roles, including Managing Partner of the San Francisco office and Senior Partner for KPMG's Latin American region. Mr. Miramontes was also an audit partner directly involved with providing audit services to public and private companies, which included working with client boards of directors and audit committees regarding financial reporting, auditing matters, SEC compliance, and Sarbanes-Oxley regulations. Mr. Miramontes currently serves on the board of directors of Lithia Motors, Inc., one of the largest providers of personal transportation solutions in the U.S., and Oportun, Inc., a mission-driven financial services company.

Mr. Miramontes brings to the Board extensive experience in accounting, financial reporting, and corporate governance. His experience as an audit partner provides useful insights into financial and regulatory matters relevant to the Company's business. His service as a member and chair

Arun Nayar. Mr. Nayar retired in December 2015 as Executive Vice President and Chief Financial Officer of Tyco International, a $10+ billion fire protection and security company, where he was responsible for managing the company's financial risks and overseeing its global finance functions, including its tax, treasury, mergers and acquisitions, audit, and investor relations teams. Mr. Nayar joined Tyco as Senior Vice President and Treasurer in 2008 and was also Chief Financial Officer of Tyco's ADT Worldwide. From 2010 until 2012, Mr. Nayar was Senior Vice President, Financial Planning & Analysis, Investor Relations, and Treasurer. Prior to joining Tyco, Mr. Nayar spent six years at PepsiCo, Inc., most recently as Chief Financial Officer of Global Operations and, before that, as Vice President and Assistant Treasurer—Corporate Finance. Mr. Nayar currently serves on the Board of Directors of Bemis Company, Inc., a manufacturer of packaging products, and TFI International Inc., a leader in the transportation and logistics industry. Bemis Company, Inc. has announced a combination with Amcor Limited and has announced that Mr. Nayar will be a member of the board of the combined company, Amcor plc, upon consummation of the transaction. Mr. Nayar is also a Senior Advisor to McKinsey & Company and to a private equity firm, BC Partners. He also serves as a board member of privately-held GFL Environmental, a BC Partners portfolio company.

Mr. Nayar brings over 35 years of financial experience to the Board. His experience as a chief financial officer provides useful insights into operational and financial metrics relevant to the Company's business.

Michael N. Regan.Katherine Quinn. Since July 2017, Mr. ReganMs. Quinn has served as vice chairman and chief administrative officer of U.S. Bancorp since April 2017 and is responsible for leading human resources, strategy, and corporate affairs at the Executive Vice Presidentcompany. Ms. Quinn joined U.S. Bancorp in 2013 as executive vice president and Chief Financial Officer for Servco Pacific Inc.,chief strategy and reputation officer. Prior to joining U.S. Bancorp, Ms. Quinn most recently served as senior vice president and chief marketing officer at Anthem, a privately heldhealth benefits company, with significant interests in automobile distributionwhere she directed the company's marketing, customer communications, digital, customer experience, and retail dealerships in Hawaii and Australia, as well as interests in other business lines. From August 2014 to March 2017, Mr. Reganstrategies. She previously served as Executive Vice President and Chief Financial OfficerAnthem's vice president of Outrigger Enterprises Group, a privately held hospitality company. Prior to that, Mr. Regancorporate marketing. Earlier in her career, Ms. Quinn served as the Hold Separate Manager on behalf of the Federal Trade Commission, overseeing the Lumiere Place Casinochief marketing and Hotel and Four Seasons Hotel in St. Louis, Missouri from August 2013 through its sale in spring 2014 and prior to that as Chief Financial Officer of Indianapolis Downs LLC,strategy officer at a casino and horse track complex located near Indianapolis, Indiana during its bankruptcy from January 2012 through its sale in February 2013. From May 2007 through December 2011, Mr. Regan was a self-employed private equity investor. Prior thereto, Mr. Regan served as Chief Financial Officerdivision of The St. Joe Company,Hartford, following leadership roles in strategy and product development at CIGNA and PacifiCare Health Systems, respectively. Ms. Quinn earned an MBA from University of Phoenix and a major real estate development company based in Florida,bachelor's degree from November 2006Hunter College. In addition to May 2007. From 1997 to November 2006, he servedher role at U.S. Bancorp, Ms. Quinn presently serves as Senior Vice President, Finance and held various other positions with The St. Joe Company and was a member of the senior management team. Prior to joining The St. Joe Company, heBoard of Directors of Taylor Corporation and the Board of Trustees for both United Way U.S.A. and Fraser, a non-profit organization serving children and adults with special needs. She previously served in various financial management functions at Harrah's Entertainment from 1980 through 1997, including as Vice President and controller from 1991 to 1997.a member of the Board of Trustees for Minnesota Public Radio until May 2019.

Mr. Regan's over 30 years of experience, including serving as a chief financial officer and as a senior vice president of finance, providesMs. Quinn brings to the Board with additional perspectives on financial, operationalextensive experience in business strategy, marketing, customer experience, and strategic planning,health benefits. Her experience and real estate mattersinsights in these areas are directly relevant to the Company.

Table of ContentsCompany's business.

Marcy Syms. Ms. Syms served as a director of Syms Corp, a chain of retail clothing stores, from 1983, when she was named President and COO, until 2012. Ms. Syms became CEO of Syms Corp in 1998 and was named Chair in 2010. In November 2011, Syms Corp and its subsidiaries filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code and ceased all retail operations. Ms. Syms is also a founding member of the board of directors of the Syms School of Business at Yeshiva University. Currently, Ms. Syms serves as President of the Sy Syms Foundation andFoundation. Ms. Syms served as Founder and President of the TPD Group LLC, a multi-generational succession planning company.company, from 2013 to 2018. Ms. Syms is also a member of the board of directors of Benco Dental.

Ms. Syms brings to the Board over 18 years of experience as a chief executive officer of a chain of retail stores, including an array of skills in strategic planning, marketing, and human resources matters similar to those faced by the Company.

Board Leadership

Mr. Standley currently servesBodaken became Chairman of the Board effective at the 2018 Annual Meeting. The Board has determined that Mr. Bodaken will continue to serve as Chairman of the Board and Chief Executive Officer. Mr. Regan has served as our Lead Independent Director since 2011. As discussed in the section entitled "Stockholder Engagement and Board Refreshment" above,Board.

In December 2018, the Board has determinedamended the Company's By-Laws to provide that effective as of the Annual Meeting, Mr. Standley will be succeeded as Chairman of the Board by Mr. Bodaken. References in this proxy statement to Mr. Standley's position as Chairman apply only toshall be a director who is independent under the period prior toNYSE listing standards and the Annual Meeting.

The Company's governance framework provides the Board with flexibility to select the appropriate leadership structure for the Company.Corporate Governance Guidelines. The Board has no policy mandating the combination orbelieves that separation of the Chairman of the Board and Chief Executive Officer positions and believes that, given the dynamic and competitive environment in which we operate, the right leadership structure may vary from time to time based on changes in circumstances. The Board makes this determination based on what it believes best serves the needs of the Company and its stockholders at any particular time.stockholders. The Board believes that Mr. Bodaken will continue to provide excellent independent leadership of the Board in his role as Chairman.

The Board expects that, asAs Chairman, Mr. Bodaken's responsibilities will subsume the responsibilities of the Lead Independent Director and will include:

Corporate Governance

We recognize that good corporate governance is an important means of protecting the interests of our stockholders, associates, customers, suppliers, and the community. The Board of Directors, through the Nominating and Governance Committee, monitors corporate governance developments and proposed legislative, regulatory, and stock exchange corporate governance reforms. In April 2019, the Board enhanced our corporate governance by amending the Company's By-Laws to permit special meetings of stockholders of the Company to be called by stockholders holding at least 20% of the Company's common stock.

Website Access to Corporate Governance Materials. Our corporate governance information and materials, including our Corporate Governance Guidelines, current charters for each of the Audit Committee, Compensation Committee, Nominating and Governance Committee, and Executive Committee, our Code of Ethics for the CEO and Senior Financial Officers, our Code of Ethics and Business Conduct, our Stock Ownership Guidelines, and our Related Person Transaction Policy are posted on our website atwww.riteaid.com under the headings "Corporate Info—Governance" and are available in print upon request to Rite Aid Corporation, 30 Hunter Lane, Camp Hill, Pennsylvania 17011, Attention: Secretary. The information on our website is not, and shall not be deemed, a part of this proxy statement. The Board regularly reviews corporate governance developments and will modify these materials and practices from time to time as warranted.

Codes of Ethics. The Board has adopted a Code of Ethics that is applicable to our Chief Executive Officer and senior financial officers. The Board has also adopted a Code of Ethics and Business Conduct that applies to all of our officers, directors, and associates. Any amendment to either code or any waiver of either code for executive officers or directors will be disclosed promptly on our website atwww.riteaid.com under the headings "Corporate Info—Governance—Code of Ethics."

Director Independence. For a director to be considered independent under the NYSE corporate governance listing standards, the Board of Directors must affirmatively determine that the director does not have any direct or indirect material relationship with the Company, including any of the relationships specifically proscribed by the NYSE independence standards. The Board considers all relevant facts and circumstances in making its independence determinations. Only independent directors may serve on our Audit Committee, Compensation Committee, and Nominating and Governance Committee.

As a result of this review, the Board affirmatively determined that the following directors, including each director serving on the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee, satisfy the independence requirements of the NYSE listing standards: Joseph B. Anderson, Jr., Bruce G. Bodaken, David R. Jessick,Busy Burr, Robert E. Knowling, Jr., Kevin E. Lofton, Myrtle Potter, Michael N. Regan, Frank A. SavageLouis P. Miramontes, Arun Nayar, Katherine Quinn, and Marcy Syms. The Board also determined that Robert E. Knowling, Jr., Louis P. MiramontesJoseph B. Anderson and Arun Nayar satisfyMichael N. Regan, who served as directors until April 2019, and David R. Jessick, Myrtle Potter, and Frank A. Savage, who served as directors until October 30, 2018, also satisfied the independence requirements of the NYSE listing standards. The Board also determined that the members of the Audit Committee satisfy the additional independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and the additional NYSE independence requirements for audit committee members. In addition, the Board has determined that the members of the Compensation Committee satisfy the additional NYSE independence requirements for compensation committee members.

There is no family relationship between any of the nominees and executive officers of Rite Aid.

Majority Voting Standard and Policy. Under the Company's By-Laws, a nominee for director in uncontested elections of directors (as is the case for this Annual Meeting) will be elected to the Board if the votes cast "for" such nominee's election exceed the votes cast "against" such nominee's election. In contested elections, directors will be elected by a plurality of votes cast. For this purpose, a contested election means any meeting of stockholders for which (i) the Secretary of the Company receives a notice that a stockholder (or group of stockholders) has nominated a person for election to the Board in compliance with the advance notice requirements for stockholder nominees for director or

the proxy access requirements, in each case as set forth in the By-Laws and (ii) such nomination has not been withdrawn by such stockholder (or group of stockholders) on or prior to the 14th day preceding the date the Company first mails its notice of meeting for such meeting to the stockholders.

Under the Company's Corporate Governance Guidelines, a director who fails to receive the required number of votes for re-electionreelection in accordance with the By-Laws will, within five days following certification of the stockholder vote, tender his or her written resignation to the Chairman of the Board for consideration by the Board, subject to the procedures set forth in the guidelines.

Board Oversight of Risk Management

The Board of Directors, as a whole and through the various committees of the Board, oversees the Company's management of risk, focusing primarily on five areas of risk: operational, financial performance, financial reporting, legal and regulatory, and strategic and reputational.

Management of the Company is responsible for developing and implementing the Company's plans and processes for risk management. The Board believes that its leadership structure, described above,

supports the risk oversight function of the Board. The Board of Directors, at least annually, reviews with management its plans and processes for managing risk. The Board also receives periodic updates from the Company's compliance and internal assurance services with regard to the overall effectiveness of the Company's risk management program and significant areas of risk to the Company, focusing on the five primary areas of risk set forth above as well as other areas of risk identified from time to time by either the Board, a Board committee, or management.

In addition, the Board and the Audit Committee receive periodic updates from the Company's Senior Executive Vice President, Chief Financial Officer, and Chief AdministrativeInformation Officer, or Chief Information Security Officer on cybersecurity matters, including information services security and security controls over credit card, customer, associate, and patient data. These updates also include information regarding the Rite Aid Information Security Program, managed by Rite Aid's Chief Information Security Officer, which is designed to protect information and critical resources from a wide range of threats in order to ensure business continuity, minimize business risk and maximize return on investments and business opportunities. The objective in the development and implementation of the Information Security Program is to create effective administrative, technical and physical safeguards in order to protect the data of Rite Aid and its subsidiaries and the data of any clients of these entities.

In addition, other Board committees consider risks within their respective areas of responsibility and advise the Board of any significant risks. For example, the Compensation Committee considers risks relating to the Company's compensation programs and policies and the Audit Committee focuses on assessing and mitigating financial reporting risks, including risks related to internal control over financial reporting and legal and compliance risks.

Compensation-Related Risk Assessment

The Compensation Committee reviews all incentive plans relative to established criteria and conducts an assessment to ensure that none of our incentive plans encourage excessive risk-taking by our executives or associates. Together with executive management, the Compensation Committee has considered the risks arising from the Company's compensation programs for its executives and associates and has concluded that the compensation policies are not reasonably likely to have a material adverse effect on the Company.

The Compensation Committee reviews the risk profile and the relationship between the Company's compensation programs to the overall risk profile of the Company. Some of the features of our incentive programs that limit risk include:

Committees of the Board of Directors